Financial Business Supports during COVID-19

Our advice in the first instance is to make contact with your Accountant and with your Relationship Manager in your Bank or Credit Union who is best placed to guide you through putting in place the necessary financial assistance your business will need during the crisis.

4 weeks ago today schools across the country closed their doors as we entered into uncertain times both personally and commercially. Since then the government have been trying to minimise the impact of loss of income for employers and employees in the country. As all of this was so sudden there was lots to be learned on all sides but initiatives include:

- Emergency Pandemic Payment: €350 available to all employees /employers who have been laid off or whose business has closed.

- Wages Subsidy Scheme: to encourage employers to keep employees on their books. 70% of net pay to be repaid to employer. Uncertainties exist in relation to this scheme due to publication of name of employer after scheme has ended and penalties if employers cannot prove Income has been affected by a minimum of 25%

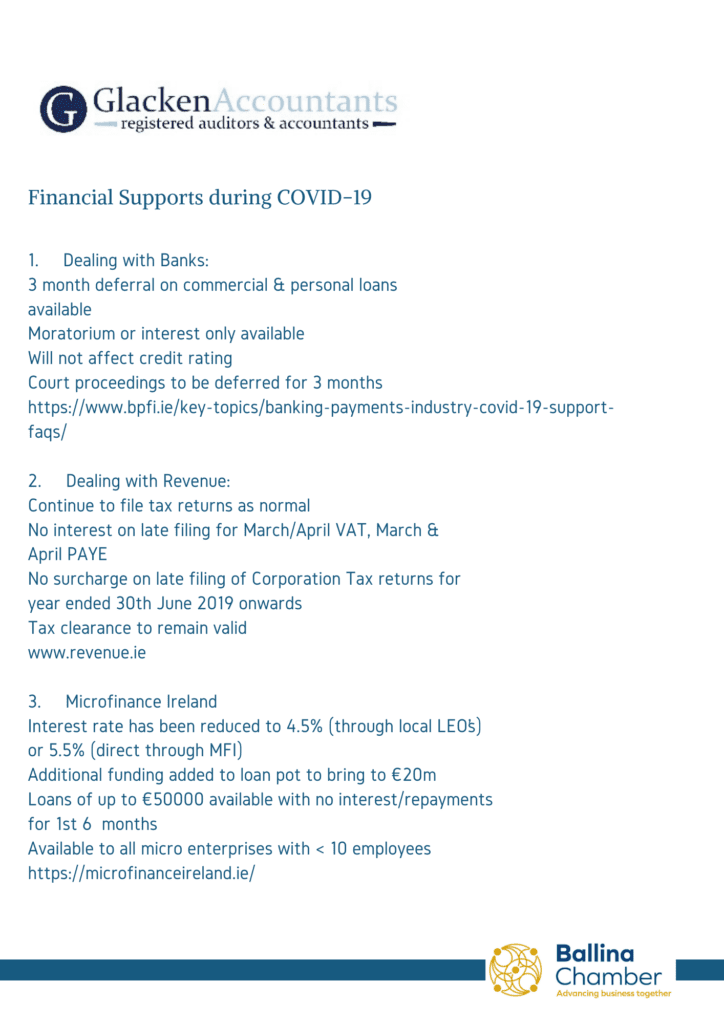

- Revenue & Banks: Deferral available on commercial and personal loans with banks. Revenue have indicated they will not charge interest on late payments of Corporation Tax, VAT & PAYE although they are encouraging tax payers to continue to file their returns as normal

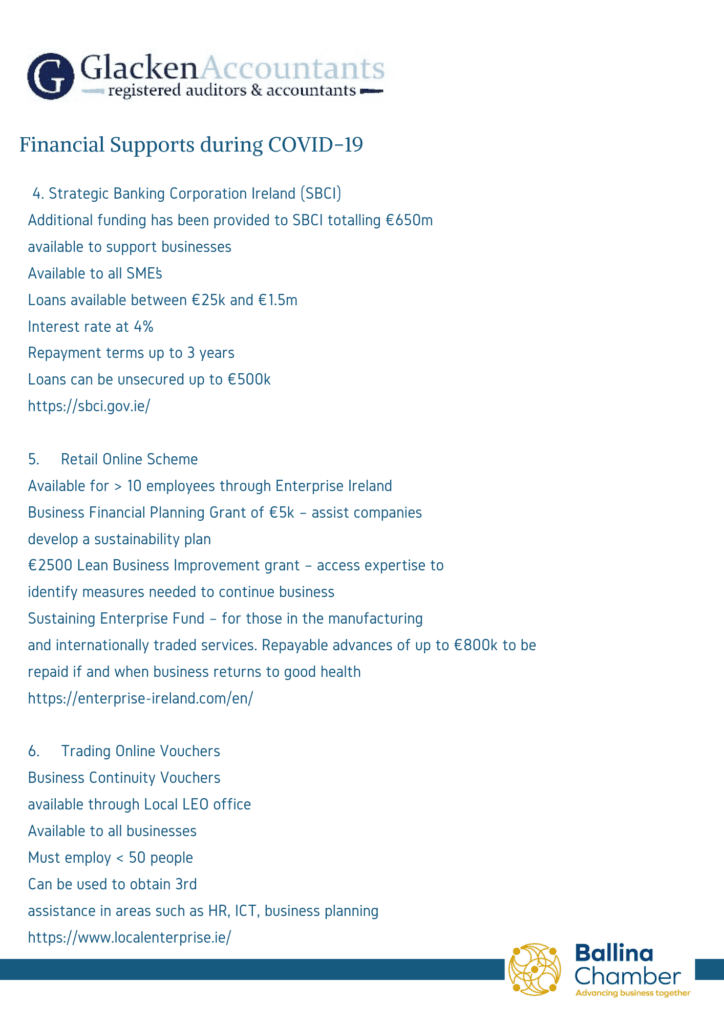

- Availing of Finance: Microfinance Ireland, Strategic Banking Corporation Ireland and Credit Guarantee Scheme are all offering finance to businesses affected by Covid 19. As of yesterday interest rates were reduced by 2.3% to 4.5% for Microfinance Ireland funding. Enterprise Ireland have also introduced schemes to assist businesses with more than 10 employees.

- Business Continuity Vouchers are being offered to all businesses with less than 50 employees who need to avail of consultancy services in order to assist their business in areas such as HR, ICT or business planning.

- Commercial rates deferral has been agreed until the end of May with priority given to those in the hospitality , retail, childcare and leisure sectors.

The above are only an example of supports available. Professional advice should be obtained or visit

https://dbei.gov.ie/en/What-We-Do/Supports-for-SMEs/COVID-19-supports/Government-supports-to-COVID-19-impacted-businesses.html for more information.

A comprehensive and structured framework for managing your Cashflow.

Copy of a Cash Flow Template – see here

All Information is current and up to date as of 10th April 2020.

This Go to Business Support Guide for COVID-19, has been compiled by Tracey Glacken Glacken Accountants Ballina, Co Mayo.