The EU’s Response to the COVID-19 Pandemic

Over the coming weeks, the Chambers Ireland team and some guest contributors, will be bringing you blogs and articles to keep you posted on how the COVID-19 crisis is impacting the economy, the environment and business, at home and abroad.

First up, is Policy and Research Executive Michaela Reilly, with the view from the EU and how the institutions are addressing the crisis.

What has been happening in the EU to combat the economic challenges of COVID-19 pandemic?

The COVID-19 crisis poses a huge challenge for the Union, where leaders have yet to agree on the best way to restore the EU and it’s member states to eventual economic normality, while at the same time mobilising huge levels of financial support to help the most vulnerable member states.

The pandemic has revived the strains of the financial and Greek debt crises. Bruno Le Maire, the French finance minister, warned this week that “either the eurozone responds in a united manner to the economic crisis and emerges stronger, or it is all over the place and is in danger of disappearing.”

President of the European Commission, Ursula Von der Leyen, stated on Monday (30 March) that while “all options are on the table”, there will need to be consensus among all 27 states so as not to create a divide in the Union based on each governments capacity to deal with the economic effects of the crisis.

How will this be achieved?

Von der Leyen has suggested that the key to reducing economic strain felt across the EU is in reducing the next Multiannual Financial Framework (MFF) for 2021-2027 (i.e. the EU Budget) – which has already faced major stumbling blocks this year resulting from how the €60-75bn funding gap left by the UK’s departure will be paid for. While this pandemic has further paralysed the MFF negotiation process, the Commission President still considers the next MFF to be an essential element of the economic recovery plan as it would allow the deployment of investment all across the EU.

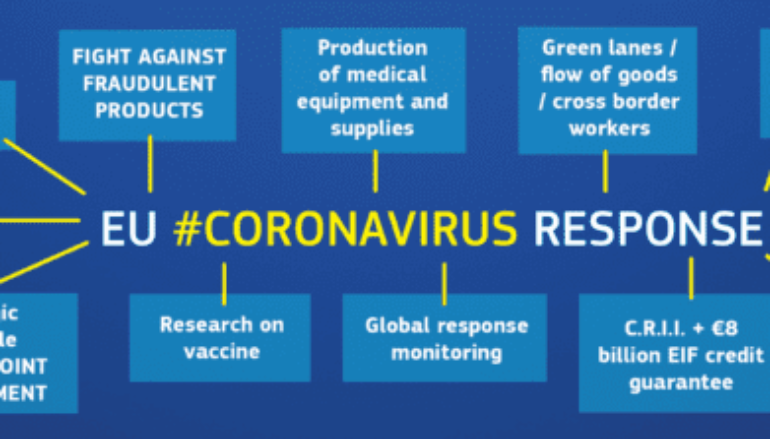

She has mobilised a Coronavirus Response Team to coordinate a response to the pandemic that has already established a €37bn Coronavirus Response Initiative Investment from the previous MFF to provide liquidity to small businesses and the healthcare sector, redirecting unused resources from the European Structural and Investment Funds (ESIF) that support regional development in the poorest regions of the bloc. More announcements from this team are due to come in the next week.

What is all of this talk about ‘coronabonds’?

Nine EU member states, including Ireland, France, Spain and Italy, have advocated for the EU to issue coronabonds which would enable a mutualised asset to share some of the direct fiscal costs from the pandemic. The idea is that the nine countries would set up a mutualised bond that is backed by themselves. They could then challenge the ECB to buy these securities as part of its pandemic emergency purchasing programme.

Legally, a mutualised debt instrument between a group of sovereign states would still count as national debt. The repayment obligation would be shared. While this would not reduce the debt load of vulnerable member states in a way that a properly designed EU-wide instrument could it would, at the very least, set a precedent and raise funds fast.

Germany and the Netherlands were two of the leading opponents to this proposal which was, predictably, quelled at the European Council Summit last Thursday (26 March). Head of the eurozone’s bailout fund, Klaus Regling, also weighed in, stating that it would likely take between one and three years to establish a new institution to issue the so-called coronabonds. The best that leaders could manage at the Summit was to order eurozone finance ministers back to the drawing board with a 14-day deadline to design workable proposals by 7 April.

Have there been any other big proposals for financing this crisis at the EU-level?

So far, there are two frontrunners in terms of EU instruments for a major fiscal response:

- Using the European Stability Mechanism (ESM) for emergency credit lines (Enhanced Conditions Credit Lines)

- A Pan-European Guarantee Scheme (€40bn), using the Triple A rating of the European Investment Bank.

The intricacies of the Pan-European Guarantee Scheme have yet to be clarified by the EIB, therefore the ESM option is currently a more attractive option for most member states as it has €410m capacity to allow member states borrow up to 2% of their GDP at low interest rates.

It should be noted that there was “broad agreement” to use the ESM at the Eurogroup meeting on 26 March, but not unanimity so we will have to watch this space on 7 April.

Despite the dispute over coronabonds, the EU and its members have reacted aggressively to the economic fallout from the pandemic. A five and a half hour European Council Summit, via video-link, on Thursday (26 March) saw leaders agree on a range of measures that would that would speed up the flow of goods around the single market, accelerate funding for vaccine research, start the process of stockpiling vital medical supplies, prevent the hostile foreign takeover of European companies whose share prices were tumbling, ensure the EU exits the crisis in a coordinated manner and help EU citizens stranded around the world get home.

Meanwhile some measures being taken by various EU Institutions include:

- The Commission has relaxed its State Aid rules with the introduction of a Temporary Framework which introduces five categories of measures designed to help member states to support businesses facing a sudden shortage or unavailability of liquidity as a result of the Covid-19 pandemic.

- The ECB has announced a €750bn Pandemic Emergency Purchase Programme until the end of the year, in addition to the €120bn they committed to on 12 March.

- The European Parliament approved three urgent proposals: the Coronavirus Response Investment Initiative (€37bn); an extension of the EU Solidarity Fund (€800m); and a temporary suspension of EU rules on airport slots.

- The Commission issued new practical advice on how to implement its Guidelines for border management

What are the benefits for Ireland?

On Tuesday (31 March), the European Commission approved a €200m State scheme to provide loans to struggling Irish manufacturing or exporting businesses.

The loan scheme was approved under a new temporary EU framework introduced on 19 March 2020 to relax the normally strict State aid rules to battle the economic effects of the virus. Manufacturers and exporters with at least 10 staff, and which fear turnover will fall by at least 15%, can apply for loans of between €25,000 and €800,000 for liquidity to tide them through the crisis. The scheme is limited to companies with annual sales of less than €500 million.

The loans can be used for purposes such as restructuring or to plug holes in liquidity. The €200 million scheme is run in addition to a separate €200m loans fund run by the Irish government, the Strategic Banking Corporation of Ireland, to provide working capital supports.

However, Ireland is only eligible for €3 million in support from the Corona Response Investment Initiative overall. This contrasts with Italy which is eligible for €853 million of liquidity, to be topped up by €1.46 billion from the EU budget and will be able to spend €9 billion of unallocated cohesion money, half of which will come from the EU budget.

While we try to keep abreast of the situation unfolding at home, what is going on in the rest of Europe?

Many other EU member states have also introduced a range of measures in the same manner as Ireland, placing moratoriums on repayments of personal and business loans, as well as freezes on the payment of a range of taxes and supports for the continuity of business post-crisis. One of the most notable tax reductions has been introduced in Latvia where the State Revenue Service is permitted to provide businesses with a special permit to perform storage operations and who manufacture alcohol with an excise tax discount of up to 90%.

While leaders in Italy and Spain grapple with the highest number of virus infections, their Hungarian counterpart, Viktor Orbán, has focused his efforts on cementing his position rather than battling the virus. On Monday (30 March) the Hungarian parliament approved a very controversial bill that extends the state of emergency and allows Orbán to govern by decree for an indefinite period of time until the government decides the emergency is over, removing the current requirement for MPs to approve any extensions to decrees. What’s more is that elections cannot be held during the emergency period. So it seems that COVID-19 may not be the only virus taking hold…

Some concluding remarks

Overall it looks like the European Council’s economic reform package will be launched in steps – some countries, notably the Italians and to a lesser extent the Spanish, want fewer ‘steps’ than others. But there is a strong sense that this is unprecedented – it literally will not be used as a precedent in future.

Useful Links

- Eurochambres Statements

- Chambers Ireland Guide to COVID-19 Policy Responses – View from the EU

- EU’s Economic Response to COVID-19

- Communication from the Commission to the Council on the activation of the general escape clause of the Stability and Growth Pact

- Temporary Framework for State aid measures to support the economy in the current COVID-19 outbreak

- Minister Humphreys Welcomes EU Approval on €200m Fund to Support Irish Business during Covid-19 Crisis

- ECB’s response to the Coronavirus emergency

- Regulation regarding specific measures to mobilise investments in health care systems of the Member States and in other sectors of their economies in response to the COVID-19 outbreak

- Commission creates first ever rescEU stockpile of medical equipment

- EU foreign investment screening regulation enters into force

- Commission presents practical guidance to ensure continuous flow of good across EU via green lanes

- Fever Pitch: Europe’s Covid-19 Crisis

Taken from Chambers Ireland,

https://www.chambers.ie/